What is an LLC?

March 18, 2018

Are you getting ready to start a new business venture and wondering if you should form an LLC? An experienced CPA in San Antonio TX can help you make that decision, but first you should learn more about what an LLC is and what it can do for your enterprise.

Are you getting ready to start a new business venture and wondering if you should form an LLC? An experienced CPA in San Antonio TX can help you make that decision, but first you should learn more about what an LLC is and what it can do for your enterprise.

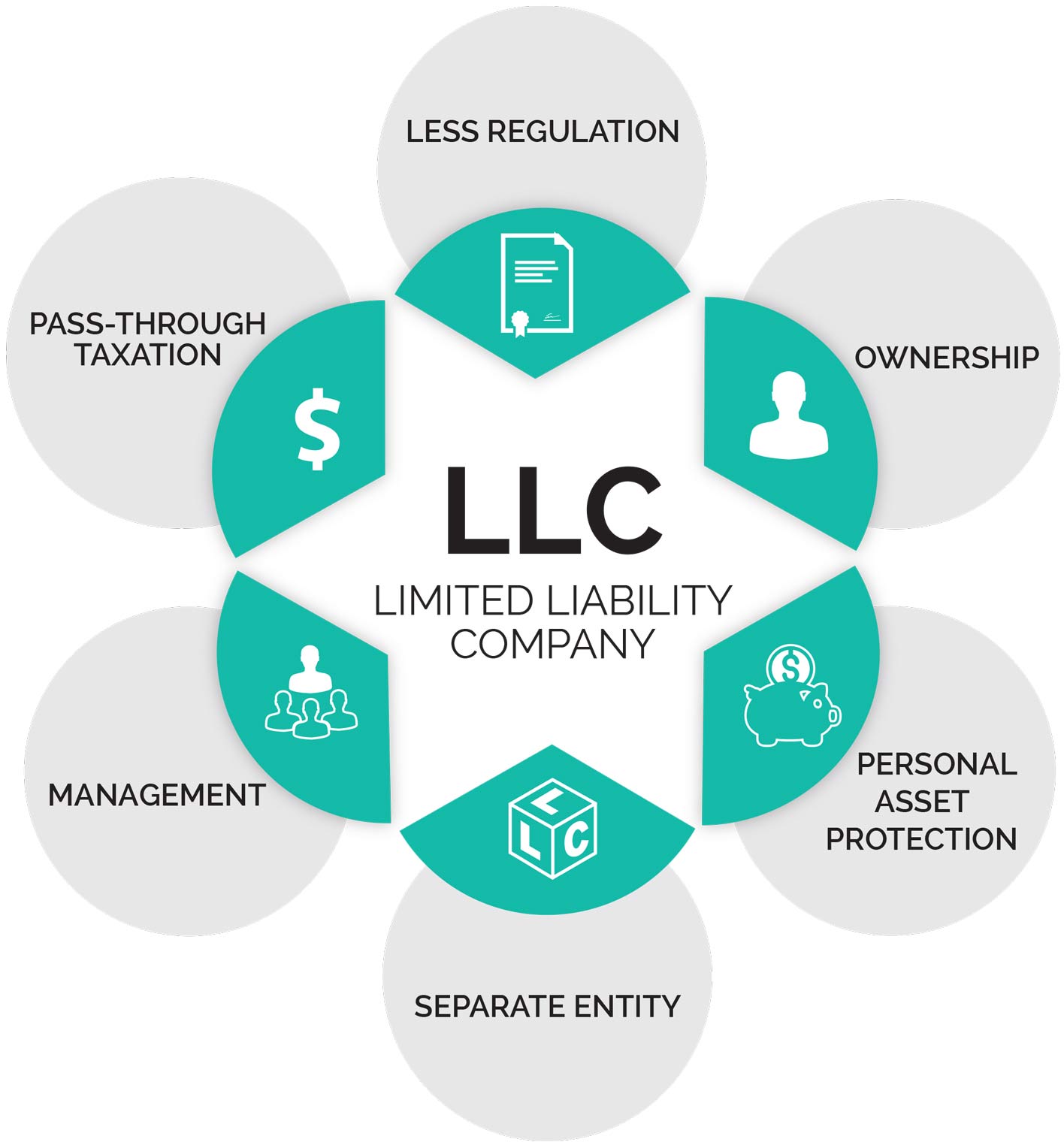

An LLC, or Limited Liability Corporation, is a type of business structure that offers certain protections for its owners. The owners, referred to as “members,’ enjoy the tax advantages and flexibility of a partnership while receiving the benefit of limited liability for the LLC’s debts.

Since the IRS doesn’t consider an LLC to be a separate entity apart from its members, it is not taxed directly. Rather, federal income taxes pass through the LLC and are paid through the members’ personal income tax returns. A CPA can help members decide which returns to file based on whether the LLC is formed as a partnership, sole proprietorship or corporation.

LLC’s, like any business structure, have advantages and disadvantages.

Advantages:

- Owner liability for company debts is limited.

- Owners report profits or losses on personal tax returns.

- Less recordkeeping is required.

- LLC’s are not required to have annual shareholder meetings.

- Can be owned by any number of individuals or businesses, including foreign ones.

- Improved profit-sharing.

- Formal operating agreement is not required (although it is recommended).

Disadvantages:

- Owners pay self-employment taxes.

- Taxes and fees are higher in some states.

- Benefits such as medical coverage are less available.

- Must submit state reports each year.

LLC’s share some of these characteristics with other business types, including sole proprietors, C corporations, S corporations and general partnerships. A CPA can help you decide which business type is best for your new venture.

If you and your CPA decide that an LLC is the right form for your business, there are certain steps you’ll have to follow to put it into place. You’ll have to choose a name, register your LLC, draft an operating agreement, get any necessary licenses and permits and announce your business in the local newspaper. Once the LLC is up and running, you’ll have to keep accurate records, pay ongoing taxes and fees and document activities such as annual meetings.

Contact an experienced CPA to decide whether an LLC is right for you. Call Gonzales Group CPA in San Antonio TX at 210-366-9430 for help setting up and running your LLC.

Tags: Accountants San Antonio tx, IRS Accountants San AntonioCategorised in: Business Tips

This post was written by Gonzales Group CPA